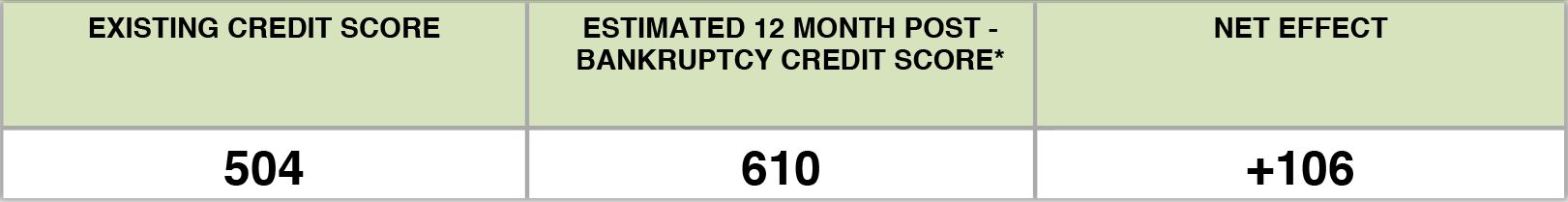

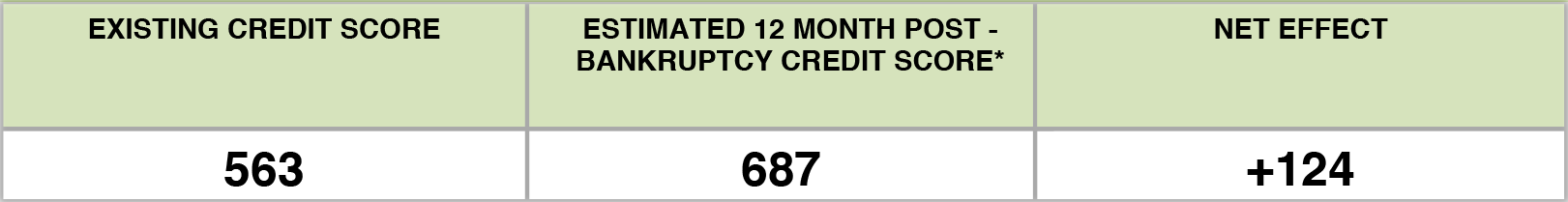

Contrary to popular belief, bankruptcy's impact on credit score is more of a positive impact than a negative one. It is not uncommon for a person to see an 80-150 point increase in credit score in as little as a year after filing bankruptcy.

Contrary to popular belief, bankruptcy's impact on credit score is more of a positive impact than a negative one. It is not uncommon for a person to see an 80-150 point increase in credit score in as little as a year after filing bankruptcy.

How is credit score determined?

A credit score is a three digit score that financial institutions use to determine credit worthiness before approving a loan. In order to determine credit worthiness, the score looks at a the following factors:

- public records such as bankruptcy, liens and judgments

- accounts that are reported as in collections

- number of open accounts including age of account (i.e. how long the account has been open)

- credit limit and amount of available credit on accounts

- account payment history

- and time since last delinquency

A person with negative information reported from multiple of the above factors will result in a lower credit score than one who has one or no negative information reported.

Most who are considering bankruptcy are not delinquent with just one account or have just one account in collections; most people considering bankruptcy have tried everything in their power to maintain payments on all of their debt by juggling money they have to pay their bills. This may result in an account getting paid one month while letting another account become delinquent then do the reverse the month following. Eventually, all accounts become delinquent because of an unforeseen event such as illness, loss of employment or unanticipated expense that disrupts the cycle.

Bankruptcy impact on credit reporting.

Real Client Estimation

If you noticed, we listed public record of bankruptcy in the list of negative things that impact a credit score first. This was listed first intentionally because it is true that bankruptcy will have a negative impact on your credit score and that the bankruptcy will continue to be reported on the credit report for 7 to 10 years; however, the bankruptcy impact on credit it is not the "dooms day" of your credit as it is just one of the several types of negative information that may be reporting your credit report on an ongoing basis. Plus, the impact the bankruptcy has on your credit score decreases as times passes. Bankruptcy discharges most if not all of your liability for debts which means

If you noticed, we listed public record of bankruptcy in the list of negative things that impact a credit score first. This was listed first intentionally because it is true that bankruptcy will have a negative impact on your credit score and that the bankruptcy will continue to be reported on the credit report for 7 to 10 years; however, the bankruptcy impact on credit it is not the "dooms day" of your credit as it is just one of the several types of negative information that may be reporting your credit report on an ongoing basis. Plus, the impact the bankruptcy has on your credit score decreases as times passes. Bankruptcy discharges most if not all of your liability for debts which means

- creditors stop reporting the account that's in collections

- creditors can not collect on that judgment lien

- the tax agencies will withdraw a portion if not their entire lien

- accounts will stop reporting the delinquent status

- accounts will no longer report a high account balance in relation to the credit limit

which allows for a constant increase in the time since the last reported delinquency.

Bankruptcy impact on credit score after bankruptcy.

Real Client Estimation

As a result, it is not uncommon for a person to see a 80 to 150 point increase in their credit score in as little as twelve months after filing because the bankruptcy impact on credit score. At The above images showing credit score and projected credit score are from real clients. The credit score increase is even greater if you have a car or mortgage that you're assuming responsibility for even after the bankruptcy as this debt will provide positive reporting on your credit report for timely payment history. Some of your old credit card holders may actually reissue another credit card in your name. Why would a creditor do that? The creditor knows that most of your prior liabilities have been discharged leaving disposable income for the repayment of that new credit card or car loan they're offering.

As a result, it is not uncommon for a person to see a 80 to 150 point increase in their credit score in as little as twelve months after filing because the bankruptcy impact on credit score. At The above images showing credit score and projected credit score are from real clients. The credit score increase is even greater if you have a car or mortgage that you're assuming responsibility for even after the bankruptcy as this debt will provide positive reporting on your credit report for timely payment history. Some of your old credit card holders may actually reissue another credit card in your name. Why would a creditor do that? The creditor knows that most of your prior liabilities have been discharged leaving disposable income for the repayment of that new credit card or car loan they're offering.

Learn More: Bankruptcy Limits

Posted in Credit Tagged bankruptcy, credit, credit score Comments Off on The Truth about Bankruptcy’s Impact on Credit Score